The world of digital assets is growing fast, and NFT investment strategies for beginners have become a popular topic in the United States. Many people want to understand how these assets work, how to make money with them, and most importantly, how to stay safe while exploring this new space. A non-fungible token definition is simple: an NFT is a digital item stored on a blockchain that proves ownership of something unique. This guide is designed to explain the process step by step and to help you avoid common mistakes while building a strong NFT portfolio.

The key idea is that NFTs are not just images or collectibles but digital certificates that confirm NFT ownership rights. You can think of them as proof of authenticity for both digital and real-world items. By following the right approach and paying attention to details like NFT marketplaces, NFT royalties, blockchain transactions, and the role of crypto exchanges, beginners can slowly build confidence in this field. With the right mix of patience and knowledge, it becomes easier to understand how NFTs work and why they are seen as part of the future economy.

What Are NFTs and How Do They Work?

Before you can design solid NFT investment strategies for beginners, you must understand how NFTs work. NFTs are built on smart contracts that live on blockchains such as the Ethereum blockchain and the Solana blockchain. A blockchain is a digital ledger that records transactions securely and transparently. What makes NFTs different from cryptocurrencies is that each token is unique and cannot be exchanged for another token in a one-to-one way. That is the heart of the non-fungible token definition.

When you buy NFTs online, you are buying digital proof that links you to a specific asset. This link cannot be altered because it is stored on the blockchain. It may represent digital collectibles, artwork, music, videos, or even NFTs as tokenized real-world assets like property deeds. Each transaction is a transfer of ownership via blockchain, making the record permanent. In simple words, NFTs allow both NFT creators and buyers to track ownership without depending on a middleman.

A Brief History of NFTs

The story of NFTs began in the mid-2010s when developers experimented with the concept of unique digital items. Early examples like Rare Pepes and CryptoKitties showed the world the potential of blockchain beyond cryptocurrency. However, it was projects such as CryptoPunks and Bored Ape Yacht Club that made NFTs mainstream. These NFT collections became cultural icons and shaped the way people understood NFT investment strategies for beginners.

In the United States, NFTs gained popularity when big brands, celebrities, and sports organizations entered the space. Platforms like Sports NFTs (NBA Top Shot, NFL All Day) showed how blockchain could be used for fan engagement and ticketing. Today, millions of dollars flow through NFT trading platforms, with marketplaces like OpenSea and Rarible driving adoption. The history shows that NFTs are not a passing trend but an evolving technology with real-world impact.

Types of NFTs You Can Invest In

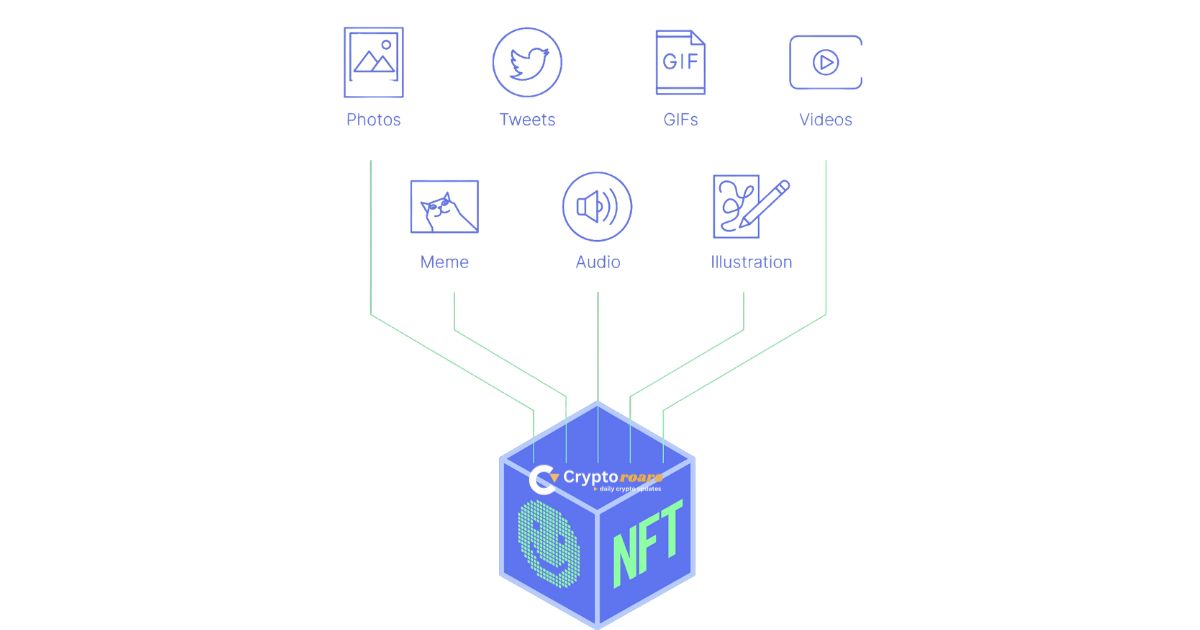

Understanding the types of NFTs (digital art, music, real estate, and domain names) is essential before starting any investment. Digital art is the most common form, where artists upload their work and sell it as NFTs. Collectors value these because of their NFT as digital proof of authenticity. Music and video NFTs are also growing, allowing musicians and filmmakers to connect directly with fans.

Another major category is metaverse assets, such as virtual land and avatars. Many games now use NFTs to sell in-game items like weapons, skins, and collectibles. Utility NFTs provide access to events, clubs, or online services. Finally, NFTs as tokenized real-world assets include property deeds, certificates, or licenses that exist both in the physical and digital world. This variety gives investors many opportunities to build diverse strategies.

Benefits of Investing in NFTs

The benefits of NFTs are often discussed in terms of authenticity, ownership, and transferability. The blockchain provides transparency, which means no two tokens can be identical. This creates scarcity, a key factor in increasing value. Ownership is another major advantage. With NFTs, buyers receive permanent rights recorded on the blockchain, making them true holders of the item.

NFTs also allow for content monetization opportunities. NFT creators can add NFT royalties and creator income, meaning they get a percentage every time the NFT is resold. This system ensures long-term earnings for creators while giving investors a way to profit through reselling NFTs. Additionally, the ability to trade assets quickly across NFT marketplaces creates liquidity that traditional markets lack.

Risks and Challenges of NFT Investment

Like any new industry, NFT investing comes with risks. One of the biggest is smart contract vulnerabilities. If the code of the NFT is flawed, it could be exploited. Another problem is market volatility and pricing challenges. The value of NFTs can swing widely, making it hard for beginners to know when to buy or sell. These are real risks of buying NFTs that cannot be ignored.

Legal issues add another layer of difficulty. Intellectual property disputes are common when creators upload stolen content. Governments are also debating whether NFTs should be treated as securities, which would lead to strict rules. On top of that, scams, phishing attacks, and cybersecurity threats are frequent. This makes it vital for newcomers to adopt safe practices when exploring NFT investment strategies for beginners.

Where to Buy and Sell NFTs: Marketplaces Explained

The backbone of the NFT world is the network of NFT marketplaces. These platforms allow users to buy NFTs online and sell NFTs easily. OpenSea, for example, is the largest marketplace built on the Ethereum blockchain, offering a wide range of NFT collections. Rarible supports cross-chain NFT compatibility, allowing trading on multiple blockchains.

Other popular platforms include Magic Eden, which focuses on the Solana blockchain, and Binance NFT, which is linked to one of the world’s biggest crypto exchanges. Each marketplace has unique NFT marketplace fees and commissions, so beginners should compare before making decisions. Smaller, niche platforms like NBA Top Shot or NFL All Day focus on sports memorabilia, providing special opportunities for fans.

Setting Up Your NFT Wallet and Account

To start trading NFTs, you need an NFT wallet setup. Popular wallets in the USA include MetaMask, Trust Wallet, and Coinbase Wallet. These wallets store both your NFTs and the cryptocurrency required for transactions. Setting up MetaMask or Trust Wallet is simple, but you must keep your recovery phrase safe at all times. Losing it means losing your assets.

Once you create your wallet, you must connect it to a marketplace. Connecting a wallet to an NFT marketplace enables direct buying and selling. This step is crucial in any NFT investment guide, as it allows you to operate securely without depending on third-party platforms. Think of it as opening a bank account, but one that gives you more control and flexibility.

Funding Your Wallet Safely

The next step is funding a crypto wallet with the currency supported by your chosen marketplace. For Ethereum-based platforms, you’ll need ETH, while Solana platforms require SOL. You can buy these coins on regulated US crypto exchanges like Coinbase, Gemini, or Binance.US. Always make sure the exchange you use is registered to avoid scams.

When transferring funds, double-check the network type. Paying transaction fees in crypto requires precision because sending money to the wrong blockchain could mean permanent loss. For example, sending ETH to a Solana address will result in a failed transfer. Beginners should always start with small amounts until they feel confident handling larger transactions.

How to Buy NFTs Step by Step

Buying NFTs requires patience and careful attention. Most NFT marketplaces allow two methods: buying at a fixed price or participating in NFT auction types (timed auction, Dutch auction). A fixed price purchase is instant, while auctions can last several days. Auctions may drive up prices quickly, so beginners should learn bidding strategies before engaging.

Another point to remember is gas fees. These are charges paid to process blockchain transactions, and they vary depending on the network. On the Ethereum blockchain, gas fees can be high during peak hours, while the Solana blockchain is usually cheaper. Beginners should always ensure they have enough funds to cover both the NFT price and the fees.

How to Sell NFTs Effectively

Selling NFTs can be done in different ways. The first is minting NFTs directly on a marketplace. NFT minting standards (ERC-721, ERC-1155) define how these tokens are created on the blockchain. Minting lets NFT creators upload their work and set conditions like royalties. Once minted, the NFT can be listed for sale.

The second method is reselling NFTs that you already own. Platforms allow you to set a fixed price or auction terms. The NFT listing process is straightforward but may involve fees. Choosing the right strategy depends on market demand and timing. Good NFT reselling strategies often require watching trends closely and moving quickly when opportunities arise.

Why Do People Buy NFTs? Understanding the Value Drivers

People buy NFTs for different reasons. Some see them as investments, hoping to profit from rising demand. Others want access to communities or events that require NFT ownership. For example, some projects offer memberships, exclusive content, or voting rights in community-driven NFT platforms (DAO, governance tokens).

Emotional value is another driver. Collectors enjoy owning rare digital art or unique digital collectibles. NFT as digital proof of authenticity makes them confident that no one else can claim the same item. In the USA, sports fans are particularly active in Sports NFTs (NBA Top Shot, NFL All Day) because they feel connected to their favorite teams and moments.

How to Build a Beginner-Friendly NFT Investment Portfolio

When designing NFT investment strategies for beginners, diversification is essential. You should not put all your money into one collection or type of asset. A balanced portfolio may include digital art, gaming items, and NFTs as tokenized real-world assets. This reduces the risk of losses if one sector falls.

Another tip is to start small. Beginners can explore low-cost NFTs first and gradually scale up. Monitoring NFT trading platforms and watching how collections perform is key. A simple table can help you track your investments.

| NFT Type | Example Marketplace | Risk Level | Potential Reward |

| Digital Art | OpenSea | Medium | High |

| Gaming Assets | Magic Eden | High | High |

| Sports Collectibles | NBA Top Shot | Low | Medium |

| Real-World Assets | Rarible | Medium | Long-Term |

Long-Term vs Short-Term NFT Investment Strategies for Beginners

Investors can choose between long-term holding and short-term flipping. Long-term strategies focus on projects with strong NFT creators and real utility. These may involve NFTs as tokenized real-world assets, gaming ecosystems, or metaverse platforms. Holding these can bring value as demand grows.

Short-term strategies rely on hype cycles and fast-moving trends. In this case, NFT reselling strategies become important. Investors buy during early stages and sell quickly when prices rise. While risky, this approach can generate quick profits if executed carefully. Understanding both methods helps beginners choose what fits their goals.

Expert Tips for Safely Investing in NFTs

Safety is a key part of any NFT investment guide. Always use a hardware wallet if you plan to invest serious money. Avoid clicking unknown links, as phishing scams are common in this space. Verify smart contracts before making purchases to ensure you are dealing with the official project.

Joining communities is also helpful. Twitter, Discord, and forums give insights into trends and NFT trading platforms. Experienced investors share their thoughts, and beginners can learn from them. The more you stay connected, the better your chances of avoiding mistakes and building smart NFT investment strategies for beginners.

Are NFTs a Good Investment for the Future?

The future of NFTs in the USA looks promising, but not without uncertainty. On one side, we see growth in industries like gaming, entertainment, and ticketing. NFT as digital proof of authenticity has practical use in property transfers and certifications. On the other side, regulatory changes and market bubbles pose risks.

Experts believe NFTs will become more stable as technology matures. Integration with cross-chain NFT compatibility will improve liquidity, and new rules may create safer environments for investors. For beginners, the best approach is to combine education with caution. By starting small and staying updated, NFTs can be a valuable part of a larger investment plan.

Final Thoughts on NFT Investment Strategies for Beginners

NFT investment strategies for beginners require patience, research, and safe practices. You must understand how NFTs work, use trusted crypto exchanges, and avoid scams. Diversification is vital, and so is keeping track of fees, especially gas fees.

The bottom line is that NFTs offer both opportunities and challenges. Whether you want to support NFT creators, explore NFT collections, or join community-driven NFT platforms (DAO, governance tokens), the future is full of possibilities. By following this NFT investment guide, you can take the first steps toward building a secure and rewarding journey in the world of digital assets.

FAQs on NFT Investment Strategies for Beginners

Q1: What is the easiest way for a beginner to start investing in NFTs?

The easiest way is to complete an NFT wallet setup, fund it through crypto exchanges, and connect it to trusted NFT marketplaces like OpenSea or Rarible before you buy NFTs online.

Q2: Do I need a lot of money to invest in NFTs?

No. Many digital collectibles and small NFT collections are affordable. Some projects on the Solana blockchain and new community-driven NFT platforms allow entry with very low fees compared to the Ethereum blockchain.

Q3: Are NFTs safe investments?

They carry risks. Issues like high gas fees, scams, or unclear NFT ownership rights are common. Always check NFT creators, smart contracts, and project reputations before investing.

Q4: How do I make money with NFTs?

You can earn through NFT reselling strategies, NFT royalties, or holding valuable NFTs as tokenized real-world assets that may rise in demand.

Q5: What types of NFTs are most popular for beginners?

Common ones include Types of NFTs (digital art, music, real estate, domain names), sports NFTs (NBA Top Shot, NFL All Day), and utility-based NFTs that provide access to communities or events.

Q6: What’s the difference between buying at a fixed price and an auction?

Buying NFTs at a fixed price vs auction differs in timing and competition. A fixed price gives certainty, while NFT auction types (timed auction, Dutch auction) may allow better deals but carry risks of overbidding.

Q7: Can I transfer my NFTs between blockchains?

Yes, some projects support cross-chain NFT compatibility, though not all do. Always verify before making a purchase.

Q8: Are NFTs a good investment for the long term?

For some, yes. With strong NFT investment strategies for beginners, patience, and research, they can be part of a diversified portfolio. But the risks of buying NFTs mean you should only invest what you can afford to lose.

For more information, keep visiting cryptoroars.com